You need to start investing in two different pension plans.

The Fiscal and the Physical.

-

Memento Mori means 'remember you must die'

-

No one complains about putting money away in a financial pension, but people neglect their physical pension entirely

-

What kind of physical experiences do you want have during the years of your life when your death is closer than your birth?

-

Start investing in your physical pension today

A memento mori is an object or picture that reminds someone of the inevitability of death and the fragility of life

The Latin phrase means ‘remember you must die’.

This is an inescapable truth over which we have no command. But what about the years that lead up to the moment when we depart this earthly realm? Save for unforeseen illness or injury, this period of time is very much in our control.

We are no strangers to financial prudence when it comes to this period of our lives but many are arriving in their latter years to find a gaping chasm in their planning process. Financial strength marred by physical weakness.

I wish I could take the credit for the phrase ‘physical pension’ but that would be unfair to the unknown stranger who passed on this piece of wisdom to me. It was 06:39 on a spring morning in 2019 when the train I had boarded departed for Manchester Oxford Road. I took an aisle seat next to ‘Mr Epiphany’. I’m going to call him that because I don’t know his real name but during a conversation which would span the following couple of hours, this is what we both had.

I was on the way to work with the British Para-Swimming team as I do every week. I was wearing my standard-issue British Swimming kit and Mr Epiphany it seemed, had a keen interest in sport so he asked me what my job was. I told him that I lead the strength and conditioning programme and we began conversing about sport and physical training.

Doctors, physios and other medical professionals will know the series of events that followed all too well, that of an impromptu and unsolicited consultation whereby a relative stranger seeks a diagnosis for some pain or illness they are experiencing. The same thing used to happen when I went for a haircut, my barber and I would chat training, I would give him advice and then I would pay him for the haircut as well. One of us was getting a really good deal, especially as funnily enough, my time in the chair always seemed to stretch past the standard 25-minute allocation!

Back on the train, Mr Epiphany told me about his past football career and the injuries that still plagued him 25 years later. He told me about the skiing accident that bust his knee and how he now feels broken, in pain and not able to do the things he wants to, particularly with his two children.

I empathised and told him that there is always a way back to improving your enjoyment of life through investing in moving better. ‘The trick is to think about longevity and engage in the kind of training that promotes it’ I said.

He looked at me and replied, ‘you know it’s funny, no one complains about putting money away in a financial pension, but what you’re talking about is investing in your physical pension and so many people are neglecting that entirely’.

We both paused as the gravity of what he had said resonated. Soon after, the train arrived at his stop. We said our farewells and as he disembarked the train, I wrote down one of the most important phrases I have ever heard.

‘Invest in your physical pension’.

Financial planners and investment providers will encourage you to think about the kind of retirement you would like to have and then suggest what always feels like over-inflated projections of what you need to be squirrelling away (preferably in one of their funds) for that to become a reality.

They prompt questions like, how much do you want to pay yourself per year during your retirement? What kind of holidays would you like to go on? How would you like to be able to support your children and grandchildren? The more comfortable, the more lavish and the more generous you want to be determines how hard you need to knuckle down and save.

All of this is true and important to consider and plan. But if you are someone who values experiences over possessions, adventures over armchairs and you don’t envisage your lust for life depleting as soon as you hit 65 years old then you need to think about your physical pension in the same light.

What kind of experiences do you want have during the years of your life when your death is closer than your birth?

Just like every good investment fund manager, I am going to give you some inside tips and suggestions on how to start, and indeed bolster, your physical pension plan through the following steps:

-

Accept your mortality and remember that your body is functionally on a steady decline

-

Draw a line under what you have done from age 10 to [insert your current age]. The sports you played, the injuries you got, the hours you spent sitting and the sedentary life you might now lead. What matters now more than anything is that you start investing.

-

Get help if you need it. Seek out professionals who can advise you and put you back on the right course.

-

Write this down somewhere you can see it: MOVEMENT IS LIFE. It doesn’t matter how much cash you have in the bank if you can’t move. You aren’t going to be able to enjoy it and reap the benefits of all those years of hard work to the full if you can’t get out and experience everything that life has to offer.

-

Now write this down and put it next to wherever you put point 3. THRASHING MYSELF DAILY IS NOT A GOOD INVESTMENT. The fitness industry currently glamourises intensity. This is fine for a period of time or short-term wins but show me a community of people who have endlessly hammered themselves over and over again and I will show you a group of people who are hiding from, or worse, ignoring pain.

Pain is the way your brain tells you that something is wrong. This might not seem important to you now but it will at some point in your life if you don’t deal with it. People might want to spend their money now and not worry about a pension. That might not seem such a good idea when they realise they need to live off £134.25 per week (current UK state basic pension).

-

Shape your training so it includes movement, stability, strength and conditioning. Within this, be a generalist and not a specialist.

There is more I could share but for first-time investors, we need to make sure you have the foundations in place. If you do the above, you will have a good physical pension waiting for you. If you want more than this, then we are here to help.

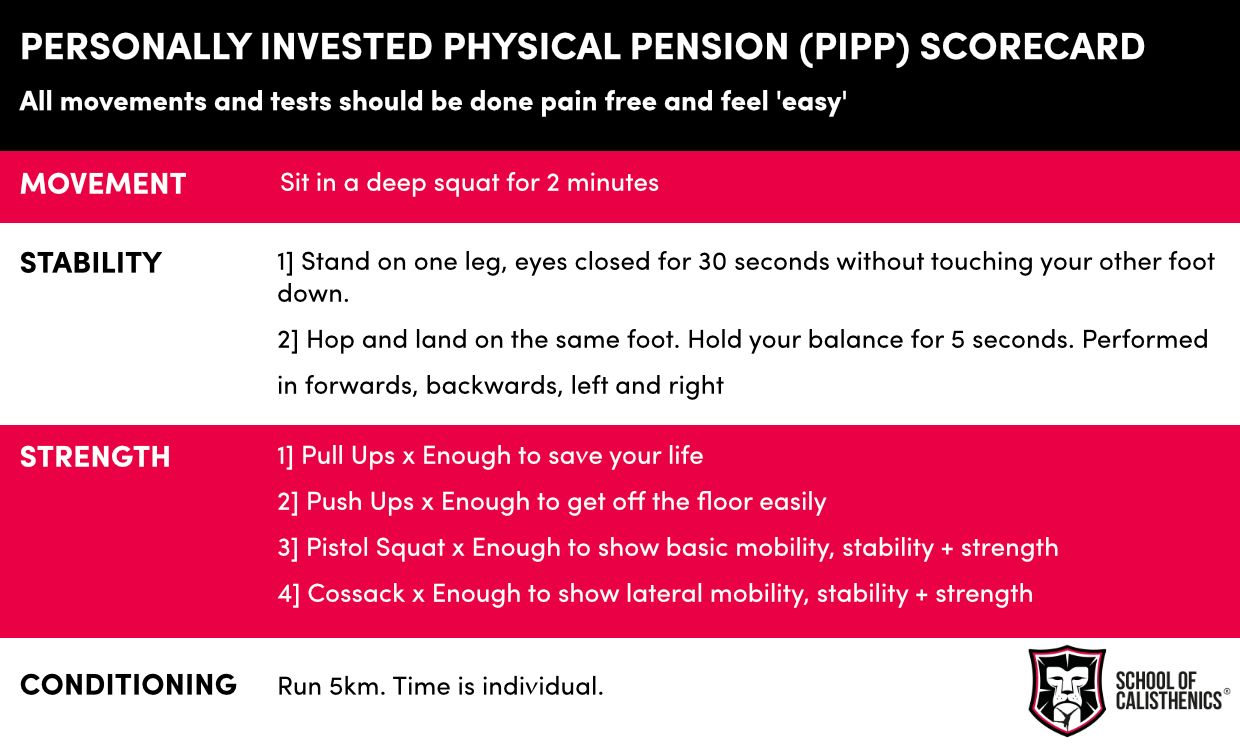

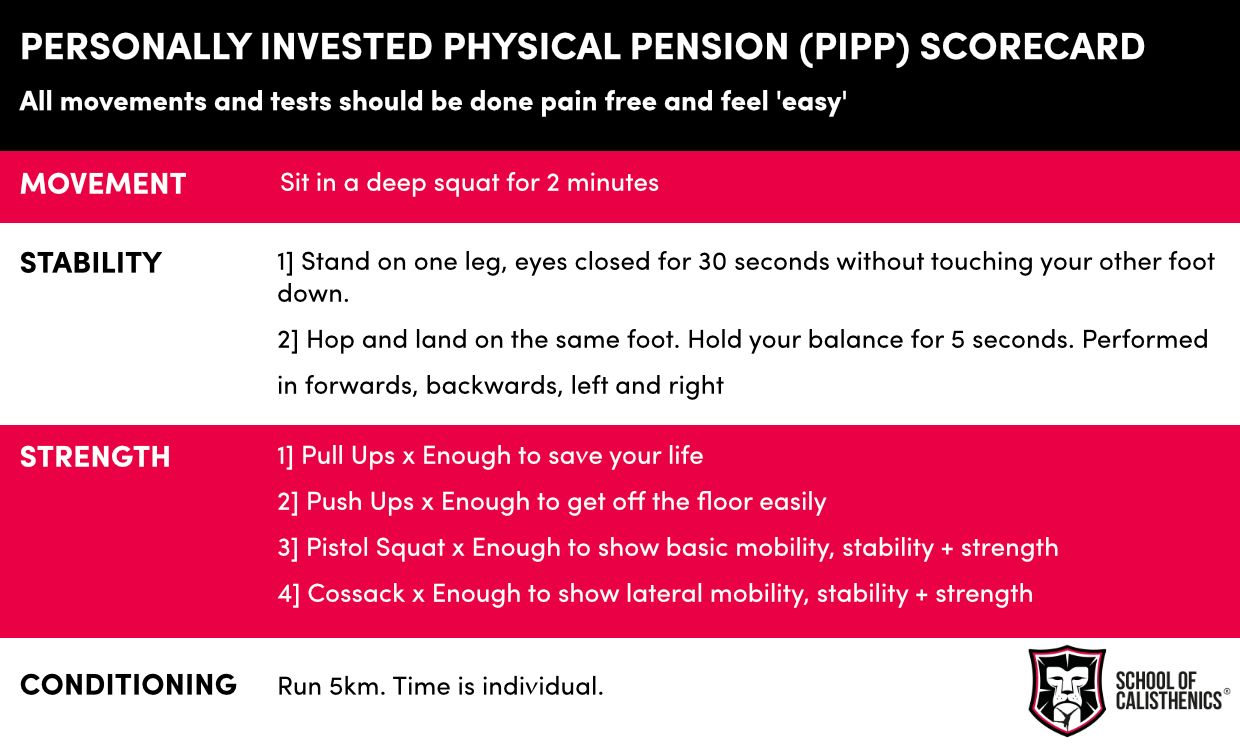

I’ll finish by setting you a little task and that is to do our Personally Invested Physical Pension (PIPP) Scorecard.

The concept is simple, you decide on the kind of life you want to live in the future and then you determine what physical attributes you will need to achieve and maintain to make that a reality.

We recommend you base them around the key pillars of Movement, Stability, Strength and Conditioning. They can be anything you like but to give you an example, here is the School of Calisthenics Physical Pension Plan.